Tax-exempt organizations, nonexempt charitable trusts (that are not treated as private foundations), and section 527 political organizations need to report their organization information to the Federal agency. IRS required them to report through Form 990-EZ.

Among contributors, these 990 forms are considered as a reliable source of information about a particular organization as IRS publish it for public inspection.

Conditions to File Form 990-EZ for Nonprofits & Tax-Exempt Organizations

Form 990-EZ is the short form of the information return filed annually by the Nonprofits & tax-exempt organizations. The organizations can file if their gross receipts are less than $200,000 and total assets are less than $500,000.

Even if your gross receipts are less than $50,000, you can voluntarily file Form 990-EZ.

What is the due date to file Form 990-EZ?

You must file Form 990-EZ before the 15th day of the 5th month after the accounting period ends.

Accounting Periods - An Overview

Every Nonprofits & Tax Exempt Organization follows any one of the accounting periods Calendar Year, Fiscal Tax Year, or Short Period.

Calendar year: A calendar year accounting period begins on January 1 and ends on December 31.

Fiscal year: If the Nonprofits & Tax exempt organization act under a fiscal year accounting period, which begins on except January 1st and ends on 12 months later.

Short period: A short accounting period is a period of fewer than 12 months. For Ex: If the organization accounting period begins on January 1st & ends before December 31.

Attaching additional information along Form 990-EZ

In addition, Form 990-EZ requires more detail in the report based on your organization type, income & expenses. This can be done through 990-EZ Schedules. When you file your 990-EZ Form, you need to attach the appropriate schedules as per the requirement.

Filing Form 990-EZ with the IRS

There is a two way to File Form 990-EZ with the IRS.

Nonprofits & Tax Exempt Organization can either file Form 990-EZ by paper or electronically.

Most of the Organization choose to file Form 990-EZ electronically to avoid the to avoid the usage of a tremendous amount of paperwork & time.

If the IRS requires the Organization to file a return electronically but the organization filed by paper, the IRS considers their return as not filed.

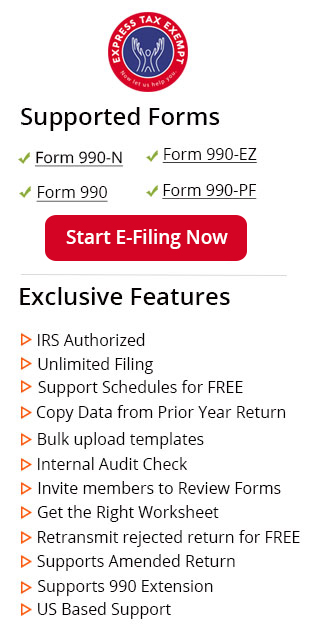

Choose the IRS Authorized e-file providers like ExpressTaxExempt to file your information with the IRS securely. This cloud based software provides a convenient way that a nonprofit organization required to file Form 990-EZ.

What If you don't have time to prepare your return?

Just spend a minute to get an extension for filing your 990-EZ return. File Form 8868 & extend your original filing deadline up to 6 months. The IRS doesn't require any explanation for filing 990 extension form 8868.

If you miss to file the 990-EZ return or extension, you will be penalized for late filing.

What if the Filed 990-EZ return has mistake?

The organization can correct the return which is filed already with the IRS at any time. You can change or add information to the previously filed return for the same period by filing an amended return.

Filing Your 990-EZ Electronically with ExpressTaxExempt

As an IRS Authorized e-file Provider, ExpressTaxExempt keeps your organization information more secure. Get started for FREE & you will be taken to the simple step by step process for preparing your return and you can ensure that you are transmitting the error-free return with the IRS at the first instant with Internal audit check feature.

Plus, You don't have to worry about schedules when you file your 990-EZ with ExpressTaxExempt, as it generates the required schedules automatically and for FREE.

If you choose to e-file 990-EZ again with ExpressTaxExempt for the upcoming tax year, you can copy the information that you have filed previously with the IRS. It helps reduces the time and effort that will take for preparing your 990 return.

Never worry about the deadline as ExpressTaxExempt sends the reminder e-mail 15 days before the deadline.

Unexpectedly, If your form gets rejected, our software will notify you of the reason for rejection, and you can correct it & retransmit it for FREE.

Finally, if you have any queries or concerns, our US Based support team are readily available to guide you throughout the filing process.

Visit ExpressTaxExempt, and start filing your 990-EZ return.